Risk management consultants

World-class business resilience

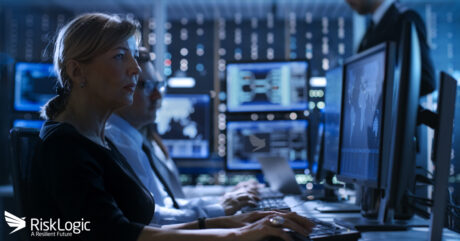

We are the leading specialised provider of resilience & risk management solutions throughout Australia & New Zealand. We empower clients to strengthen their resilience maturity using a practical and adaptive approach.

Business as usual as quick as possible

- Business Continuity

- Incident Management

- Crisis Management

- Crisis Communications

- Enterprise Risk Management

- CBCI Accredited Training

Partnered with the best software

Our partnerships allow us to provide our clients with the world’s best resilience management software solution & AI-powered risk and compliance software.

Industries We Serve

We’ve worked with 500+ organisations across 30+ industries, equipping our clients with the experience, capabilities and tools to confidently continue operations & minimise risks.

-

Education

Tertiary institutions, online learning platform providers & more.

-

Property & Retail

Retail providers, construction companies & more.

-

Finance

Banking institutions, insurance companies, brokerage firms & more.

-

Utilities & Infrastructure

Providers of electricity, natural gas, water & more.

-

Transport, Supply Chain & Aviation

Airlines, trucking, railroads, suppliers, logistics providers & more.

-

Not-for-profit

National charities, foundations, employment training & more.

-

Federal, State & Local Government

Government Departments, Statutory Authorities, Councils & more

-

Manufacturing

Electronics, automotives, clothing, food production & more.

-

Health & Aged Care

Accomodation and equipment providers, health care providers & more.

Start Building Your Resilience

We’re excited to get started working together on your resilience management. Fill out our contact form and our expert team will reach out to you shortly.